Bollinger Bands Trading Strategies| Tradingsim.com

Best un-edited videos relevant with Options Trading Education, Day Trading Profit Secrets, Forex Money Management, Range Trading Winning, and Bollinger Bands Reversal Strategy, Bollinger Bands Trading Strategies| Tradingsim.com.

In this video, we will cover 3 of the 6 bollinger bands trading strategies outlined at https://tradingsim.com/blog/bollinger-bands/. We will show you how to identify the right setups and how to make money when the market is flat or trending.

Visit Tradingsim.com to practice trading on over 2 years of historically recorded market sessions. Tradingsim is like a DVR for the stock markets. http://tradingsim.com/

Bollinger Bands Reversal Strategy, Bollinger Bands Trading Strategies| Tradingsim.com.

Forex Leading Indicators: Exists A Real Leading Sign?

Trading is among the toughest careers that you can select. Fast EMA = 12 to 10, Slow EMA = 26 to 24, MACD SMA = 9 to 7, Apply to Close. The guru is a day trader or an option-only trader, so you should be, too.

Bollinger Bands Trading Strategies| Tradingsim.com, Watch most shared high definition online streaming videos relevant with Bollinger Bands Reversal Strategy.

Automated Forex Robotics – How They Can Assist You Make Tons Of Cash

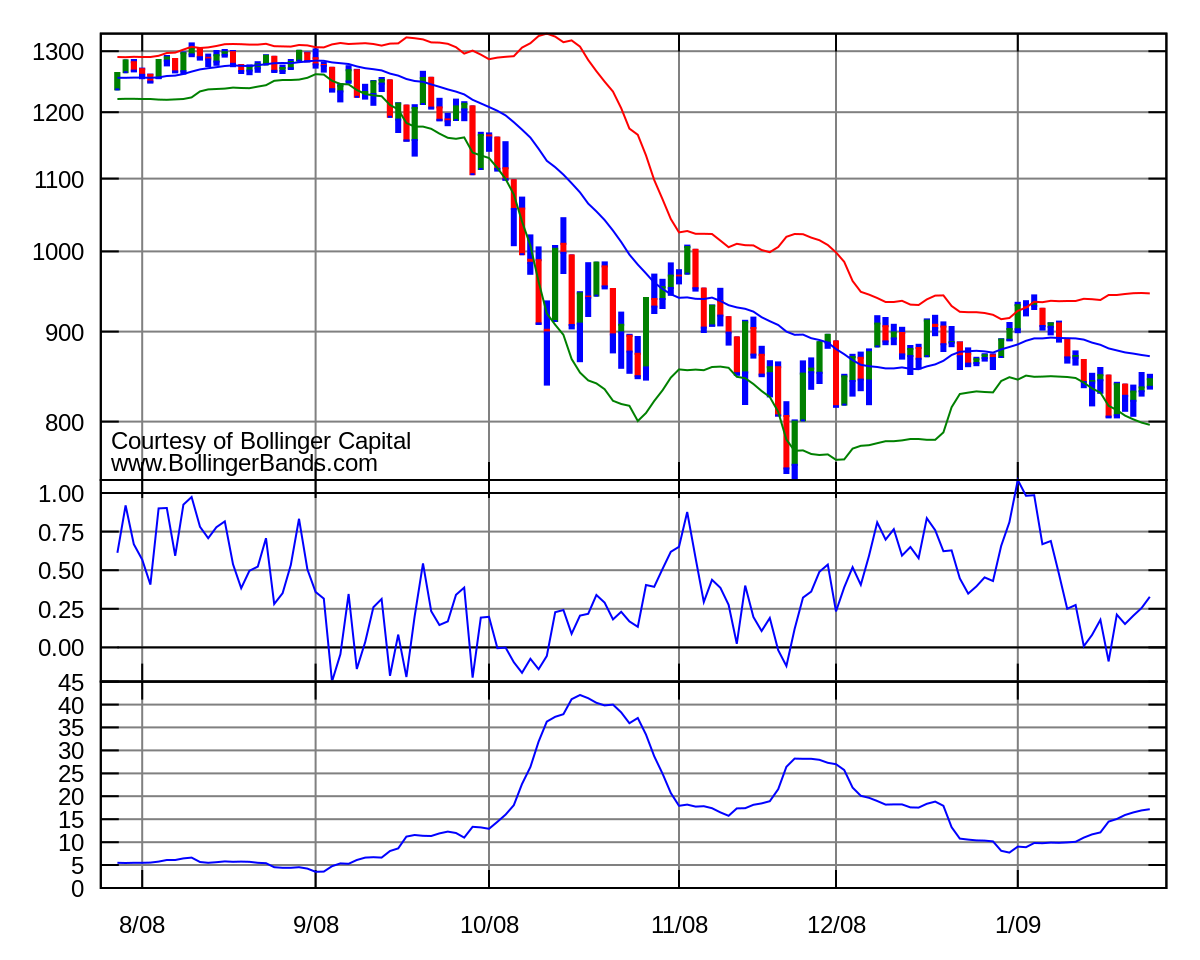

Rate will often moves within Bollinger Bands and it will be simpler for you to identify the variety border. A tool, that when used appropriately, can assist you check out the marketplace and discover entries.

Bollinger bands are quickly becoming my preferred indicator. They are really simple to use, they are user-friendly, and they tell you a lot about the market at just a glimpse. However how do you use Bollinger bands to earn money? Let me show you 3 basic steps that work almost whenever.

You may would like to know where you can get more guides about Forex trading. In truth, you can attempt to going to the site of brokers. On these sites, you will typically be able to find some complimentary ebooks. These ebooks will supply you with all the essentials and strategies you will understand. For example, you will require to learn more about some signs such as the RSI and Bollinger Bands. You will be able to earn money if you can comprehend the meaning of these indicators.

These signals are also exit signals for the opposite position. So fro example you have a brief position open and you got signal to go long. Firs close the short position then open the long position.

The 3rd chart is a six-year daily chart that reveals the 10 and 200 day MAs ratios of SPX to CBOE Put/Call (or CPC). The SPX to CPC 10 and 200 day MAs have been increasing, since SPX has actually been rising, while CPC has been falling. If the 10-day MA ratio suggest goes back, then either SPX will fall, CPC will rise, or some combination therein will occur to where the 10-day MA falls towards the 200-day MA. The fourth chart is a two-year daily SPX to VIX ratio chart with 50 and 200-day MAs. The ratio increased sharply from mid-Oct to early-Jan, when SPX rallied and VIX fell, and it’s presently near the top of the uptrend variety again above 116. The ratio tends to mean go back. So, it Bollinger Bands Trader might fall well below 100 within a month.

Stochastics – When the marketplace is trending is required to adjust the oscillator to the exact same conditions: When the marketplace is trending up, then the signals with the greater likelihood of success are those in instructions of the trend “Buy signals”, on the other hand when the market is trending down, offering signals provide the least expensive danger chances. Divergence trades are amongst the most dependable trading signals. When the indicator reaches brand-new highs/lows and the market stops working Bollinger Bands to do it or the market reaches new highs/lows and the sign stops working to do it, a divergence occurs either. Both conditions imply that the marketplace isn’t as strong as it utilized to be providing us chances to benefit from the market.

I asked him if he understood the system. He said he had no prior concept that all these technical indicators existed and could be utilized to anticipate the marketplace. He did not comprehend the mathematics behind them, but had actually been assured there is no requirement to. All he required to do is use them.

The bottom line is that it is really simple to look at the past and see all the mistakes you will have made, and you will. Nevertheless it can be very difficult to make the right decisions needed in the future to earn a profit. Unless you discover to know all the marketplace trends well, and begin to understand how the various stocks carry out, and put in the time to inform yourself then probably you will not be able to make profitable trades.

So focus only on a couple of currency sets while trading. That leaves simply 5% or a 2u00a01/2% possibility that a rate will be beyond either the 2 or -2 level. The Relative Strength of the NASDAQ exchange is strong and could reveal gains.

If you are searching exclusive exciting reviews related to Bollinger Bands Reversal Strategy, and Channel Trading, Foreign Currency Trading Software, Channel Trading System you are requested to list your email address our email list totally free.