Using the Long Strangle Options Strategy for Opportunity Trades

Top un-edited videos top searched Stochastics Divergence System, My Favorite 4 Forex Indicators and How to Use Them, Trend Follow Forex, and Bollinger Bands Uptrends Strategy, Using the Long Strangle Options Strategy for Opportunity Trades.

There are times in a trader’s life when one recognizes that a particular stock’s price has come into a cycle of coiling or consolidation and is poised for a large price breakout. Many of these episodes develop around times of low volatility and smaller price movements.

One options strategy that looks to capitalize from such a move (regardless of its direction up or down) is the Long Strangle.

Like its cousin, the Long Straddle, both profit from quick price movements and increased volatility. The Long Strangle, however, has the benefit of a lower initial cost but requires greater price movement or increased volatility in order to achieve equal profitability. A well-timed and properly executed plan can prove to be profitable.

Join Barchart’s Head of Trading Education, John Rowland, as he explores the ins and outs of the Long Strangle strategy. Learn what market characteristics, timing elements, and risks are involved, as he shows you how to pick better trading candidates. John will discuss

- how to set up the trade

- the risks involved in a Long Strangle

- how to use IV rank and percentage

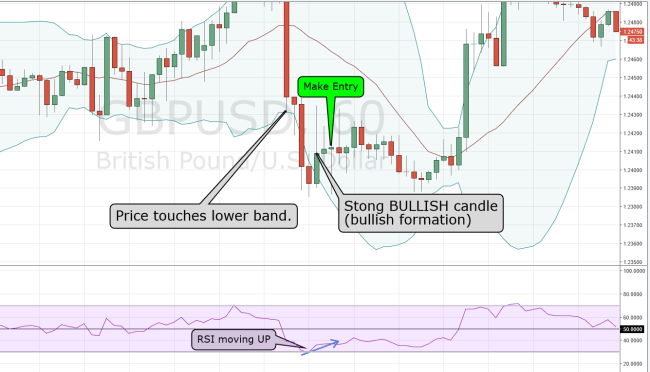

- specific chart patterns and candlestick formations to watch for

- the types of technical analysis (RSI, MACD, Bollinger Bands) that could help you find good trading candidates.

#optionstrading #tradingtips #tradingmindset

Bollinger Bands Uptrends Strategy, Using the Long Strangle Options Strategy for Opportunity Trades.

Forex Course Evaluation – 10 Minute Forex Wealth Builder

Anticipation that ‘history repeats itself’ is the basis utilized by the technical expert. Additionally, the weekly MACD and CCI are at severe levels. That’s where the concept of utilizing the stop hunters to my advantage comes in.

Using the Long Strangle Options Strategy for Opportunity Trades, Find new replays about Bollinger Bands Uptrends Strategy.

Forex Trading: The Something That Really Matters

I recommend starting with any system that based on a breakout technique. You will just be examining everyday charts to discover your trades. Low tech but consistent, this indicator provides.

When you get in trading, this is the first phase. You may have gotten a book on technical analysis someplace, become aware of a day trader making millions, or got fortunate in an earlier stock investment. After all, how hard can it be? The cash sounds enticing and the liberty to be independent noises attractive.

If you use technical analysis i.e. Bollinger Bands, you may see a break through ready to appear after the stock has been side tracking for a while. Or you might see where a stock has been consistently hitting a resistance line for a while but is trending a little upwards. Clearly it is only a matter of time till that resistance line will become the new support line.

You need to understand this that large players like the big banks, hedge funds and the institutional financiers sell a totally different manner as compared to us the little traders. As a little trader, we wish to get in and exit at one time since our order size is too small.

Somewhat related is the idea of revenge trading. Since you lost $200 in the last trade does not suggest you must expect to make it all back in a new Bollinger Bands Trader trade and set your exit limit appropriately, simply. OK, maybe you have not done that, exactly, but you ‘d be stunned how common that defective logic can be.

Her injuries were so extreme that the probability of her working again in the near future was slim at finest. She needed Bollinger Bands monetary advice, however who to rely on, she had no concept.

Fibonacci Retracement – This tool is without a doubt one of the A LOT OF commonly utilized tool in Forex. What this does is generally discover a retracement where the market will bounce and head back in the opposite direction in a nutshell. This works well on charts with candlesticks on, you draw this tool from the greatest to the most affordable peaks and vice versa. When this is done it predicts some ‘support’ and ‘resistance’ lines in which ever instructions you chose. This tool works incredibly on high amount of time charts and need to be drawn 20pips or higher.

Prior to going nuts I challenge the reader to select at random a dozen 5 year, 200 day moving average charts and to see them for the very very first time. Ask yourself an advanced concern. When its selling listed below its 200 day moving typical rather than above its 200 day moving average, why isn’t it much better to purchase a stock. Research study the charts and see them for the very first time.

This is not a veiled attempt to proselytize or evangelize. In truth, there are a large number of analytical tools offered for this function. Does that mean I am going be shorting EUR/USD tomorrow?

If you are finding exclusive exciting comparisons related to Bollinger Bands Uptrends Strategy, and Technical Analysis Education, Technical Analysis Trading you are requested to list your email address in subscribers database now.