SANTA is COMING to the S&P500! #SPY #QQQ #DIA #IWM #ARKK #BTC

Popular high defination online streaming about Trading Winning Strategies, Covered Call Option, Forex Leading Indicators, Commodity Trading, and Bollinger Band Squeeze Trading Strategy, SANTA is COMING to the S&P500! #SPY #QQQ #DIA #IWM #ARKK #BTC.

BANC Trade Alerts (TQQQ/SQQQ only): https://banctradealerts.com/subscribe/

The Stocks Channel Discord Server: https://launchpass.com/the-stocks-channel/welcome/v2

BANC “How it Works”: https://youtu.be/Ov-XhXvaFEg

BANC Website: https://banctradealerts.com/

BANC Performance: https://banctradealerts.com/performance/

TradingView Stock Charting Platform (Get $30 Signup Bonus):

https://www.tradingview.com/?aff_id=26302&offer_id=10

TradingView Tutorial: https://youtu.be/uCjdxyn3nx0

Support The Stocks Channel by becoming a Channel Member:

https://www.youtube.com/channel/UCUP_ao_7-Yct5FcVIA4Kobg/join

Twitter: https://twitter.com/stocks_channel

[0:00] Intro

[0:26] SP500/SPY

[2:52] Nasdaq100/QQQ

[3:49] Dow Jones/DIA

[4:22] Russell2000/IWM

[4:52] ARKK ETF

[5:41] VIX

[6:08] Bitcoin/BTC

[6:28] Amazon / AMZN

[6:55] Microsoft / MSFT

[7:21] Nvidia / NVDA

[7:46] Tesla / TSLA

[9:12] Apple / AAPL

[10:04] Sectors/XLF/XLI/XLV/XLE

[10:36] Summary

Santa is coming to town to save the stock market! Or at least it appears that way. Watch critical support, if it holds, there’s a good chance of a Santa rally next week. Check out the analysis!

Checkout my daily technical analysis on SPY, QQQ, DIA, IWM, ARKK, NVDA, TSLA, AAPL, Bitcoin (BTC) and more!

*DISCLAIMER: The information in this video and in this channel is for entertainment and educational purposes only and does not constitute financial advice or any type of investment recommendation. Any discussion of stocks or other investments in this video or on this channel is based on Cory’s personal opinions or those of any guests on this channel. Investing in the stock market and any other investments discussed in this video and this channel involves risk. You could lose all of the money you invest, and in some cases your losses could exceed your investment. Do not invest any money in stocks or any other investment that you cannot afford to lose. Do not rely on videos for financial advice. For personal financial advice, contact a licensed professional advisor.

*HOLDINGS DISCLOSURE: Cory may or may not hold any positions in stocks or other investments discussed in this video or on this channel. Cory may exit or add on to any positions at any time without notice.

*NOTE ABOUT PRODUCTS AND SERVICES MENTIONED IN THIS CHANNEL: Included in this channel and in some of my videos are descriptions of certain software programs, services or websites and links to those products, services and sites that I will earn an affiliate commission from for any purchases you make. You should assume that any links leading you to products, services or websites are affiliate links that I will receive compensation from them if you buy from them. Please understand that I only promote those products or services that I have investigated and truly feel deliver value to you. Thank you.

S&P500 Stock Market Technical Analysis #SP500

SANTA is COMING to the S&P500! #SPY #QQQ #DIA #IWM #ARKK #BTC

Bollinger Band Squeeze Trading Strategy, SANTA is COMING to the S&P500! #SPY #QQQ #DIA #IWM #ARKK #BTC.

Forex Trading For Beginners – A Simple 1-2-3 Step Technique For Making Money

It is a suggested to set a stop loss a couple of points under a natural support level. A great basis for this sample would be in between 18- to 25- day cycles. In cases like this, a Straddle strategy would be great to adopt.

SANTA is COMING to the S&P500! #SPY #QQQ #DIA #IWM #ARKK #BTC, Enjoy most searched replays relevant with Bollinger Band Squeeze Trading Strategy.

Can You Make Cash Trading Forex With No Previous Experience?

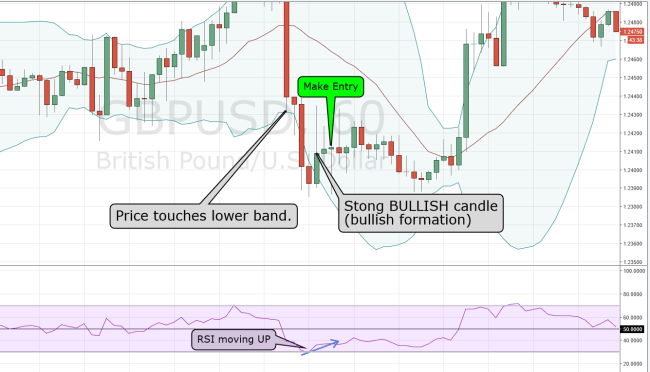

From MACD to RSI or Bollinger Bands to Variance, utilizing every indication can work versus you. How does BB King being “horrible at chords” help me and by extension you? Timings make a great deal of distinction in currency trading.

There are numerous individuals of faith, including myself, for whom religion and faith are not relegated to 60 minutes on a Sunday morning. Instead, we have an abiding belief that the principles of scripture are relevant to all locations of our life, including our trading. It is to these folks that this post is composed.

Take an appearance. Make certain you slide your chart to the day of 1/19/10 so that you can’t see the 20Th but just the 19Th and back. Notification how exceed the 10 day EMA Bollinger Bands is hooking up on the top and the bottom bands are hooking down? This is the expansion we become aware of so much. This is a signal of a big move that is about to occur.

When LMA 40 – 90 are above the LMA 120, it indicates that the market remains in up trend while listed below LMA 120 symbolizes down pattern. You must also look for overbought and over offered. Do not sign up with the traders with mentality of “it will soon reverse” at losses. Get the pattern as early as possible and follow the trend to optimize your revenues.

Bollinger Bands Trader bands plot a moving average in the middle, and the extreme bands are formed by basic deviation lines around that moving average. Now do not be terrified by the algebraic term standard variances. You don’t need to know how to compute them – the indication does that by itself.

Sometimes it may be sensible Bollinger Bands to adopt an overbought/oversold criteria for entry therefore increasing the probability of a decent sized move, and at least an initial push in the favored direction moving price away from your stop and decreasing your threat.

OThe Stochastic reveals a drop after the RSI moved up and then another push towards the upside. A turndown is anticipated in the brief term. When the market moves as expected and the RSI trades with the stochastic crossing at the same time, New positions can be taken. The technique is to wait it out given that we remain in the trade anyway. The technique puts the stop at a close basis of 2.07.

Offered the badly overbought level of copper, either an unstable debt consolidation or a large correction will take place soon. Typically, PD and FCX are more volatile than copper. Nevertheless, PD, FCX, and copper might move by approximately the very same portions. Consequently, the chart shows, if copper falls from 280 to 260, PD might fall from 85 to 80. Moreover, copper tends to move closely with gold, which reached over 600 recently, although gold is less overbought. Nevertheless, gold stocks are likewise partially discounting a pullback in the cost of gold. Within the next few months, gold might fall to 550 or 500.

Great question and the first thing is to comprehend what Bollinger bands is and what it determines. However, oil stocks stayed high and GOOG rose above $400. You can be able to find a lot on the web.

If you are searching exclusive entertaining videos related to Bollinger Band Squeeze Trading Strategy, and Live Forex Trading, Ratio Trading you are requested to join in a valuable complementary news alert service for free.