Ira Epstein's SPDR ETF Video for 1 8 2023

Popular overview about Learning Forex Trading, Forex Opportunity, Swing Trading Software, and Bollinger Bands Downtrends Trading, Ira Epstein's SPDR ETF Video for 1 8 2023.

Ira Epstein reviews the days trading in various SPDR-ETF markets. For more information and access to Ira’s free offers for traders, visit https://www.iraepstein.com.

Link to Our Website: https://www.iraepstein.com

Link for Ira’s Free Offers: https://www.iraepstein.com/free-offers/

Learn about Ira’s Charting Course: https://www.iraepstein.com/our-products/ira-epsteins-charting-course/

Commodities, Ira Epstein, Linn & Associates, Futures Trading, Online Trading, Technical Analysis, Stock Indices, S&P 500 Index, NASDAQ, Russell 2000, Treasuries, Finance, Fox Business News, CNBC, Bloomberg, Charting, SPY, QQQ, DIA, GDX, GLD, SLV, XLK, XLI,TLT, OIL, EFA, UFO, FXE, FXY, FXB,BETZ,OUSA,GMC,

AAPL,Pave,DWPCF,SLV

Bollinger Bands Downtrends Trading, Ira Epstein's SPDR ETF Video for 1 8 2023.

Utilizing The Finest Forex Chart Indication To Your Advantage

Once you have the software that has DMI/ ADX indicators, set them as follows: ADX set at 5 smooth. It might be that your stochastics have crossed and are now pointing down.

Ira Epstein's SPDR ETF Video for 1 8 2023, Explore popular replays about Bollinger Bands Downtrends Trading.

A Contrarian’s Perspective Of Technical Analysis In Today’s World

In truth, far from being a limitation, a stop loss can be an essential part of creating an effective trading method. The very first lot must be lined up with the monetary. The more the price modifications, the more pips you make.

When you begin trading, you first master how to trade with one lot. As soon as, you have mastered trading with a single lot, you ought to think about trading with multi lots. Trading multi lots is a milestone in the trading evolution of trader. Nevertheless, you must know this truth that putting multi lots is a double edged sword and comes with an increased level of risk. The threat can be fast and fast and the drawdown proportionately larger than a single lot. The challenge is to choose when to trade multi lots!

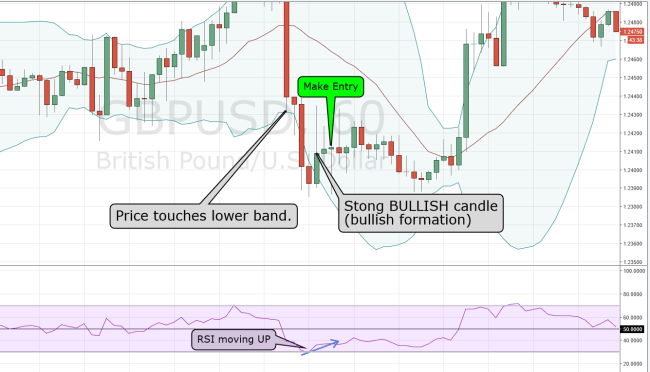

Bollinger Bands estimate the probable high and low cost of a currency pair based on market’s recent level of volatility. The bands are drawn at an equal distance above and listed below a simple moving average.

To set up MACD for scalping, deduct 2 from the default parameters i.e. Quick EMA = 12 to 10, Slow EMA = 26 to 24, MACD SMA = 9 to 7, Apply to Close. Select the Color Tab and alter the color to your favorite, you could also increase the line design. Click the Levels Tab – Add the No line and likewise change the color. You might also double-click the Description area opposite the no worth and type “Center Signal” and increase the line style too. Under the Visualization Tab, deselect the “All Timeframes” and choose M15 only because this trading technique work best on 15 minutes chart and you might also attempt it on 5 minutes. But I advise 15 minutes since of how psychological and loud the 5 minutes chart is.

Bollinger Bands Trader bands plot a moving average in the middle, and the extreme bands are formed by basic deviation lines around that moving average. Now don’t be frightened by the algebraic term standard variances. You don’t have to know how to determine them – the indication does that by itself.

The next action is to call Bollinger Bands a direct-access broker and produce an account with them. However, here it is very important for you to comprehend that day trading is regulated by certain laws. Make sure you know those laws and that you follow them completely. For example, in order to be able to trade stocks and to maintain the credibility of your account, it is legally necessary for you to have at least $25000 in your account all the times.

On the other hand, the S&P 500 has a bullish appearance with a relative strength above neutral. The index is and has a netural macd over its twenty and fifty day moving averages at 1,294 and 1,283. The next target is around 1,310 with the market needing to stick at a twenty-day moving average of 1,294 in order to stay strong.

When you need to lock in revenues or when you should place an order to sell or purchase, stochastics can assist you if you desire to determine. However, don’t just depend on one of these indications. Usage several of them and change your trading strategy according to what you see.

However you do not need to purchase anything to download his $4,983 each day Mega Pattern System and his Trading Report. If I wished to master Bollinger bands how would I go about it? The bands are 2 standard deviations away from the average.

If you are looking unique and entertaining reviews related to Bollinger Bands Downtrends Trading, and Forex Trading With Bollinger Bands – a Trending Trading Strategy That Just Plain Works!, Trading Room, Stock Pick, Volatility Trader dont forget to subscribe in subscribers database for free.