Bollinger Bands Secret Pattern – Webinar Part 1 by Vladimir Ribakov

Latest updated videos top searched Forex Opportunity, Commodity Trading, and Bollinger Band Reversal Pattern, Bollinger Bands Secret Pattern – Webinar Part 1 by Vladimir Ribakov.

👉👉👉 Check Out My Trading Club – http://b.link/tac-5mvtop

I love bollinger bands and anyone out there using this fantastic indicator knows what i’m talking about and why i’m so connected to it!

If you know how to use the bollinger bands the correct way you will be amazed how much this indicator is telling you.

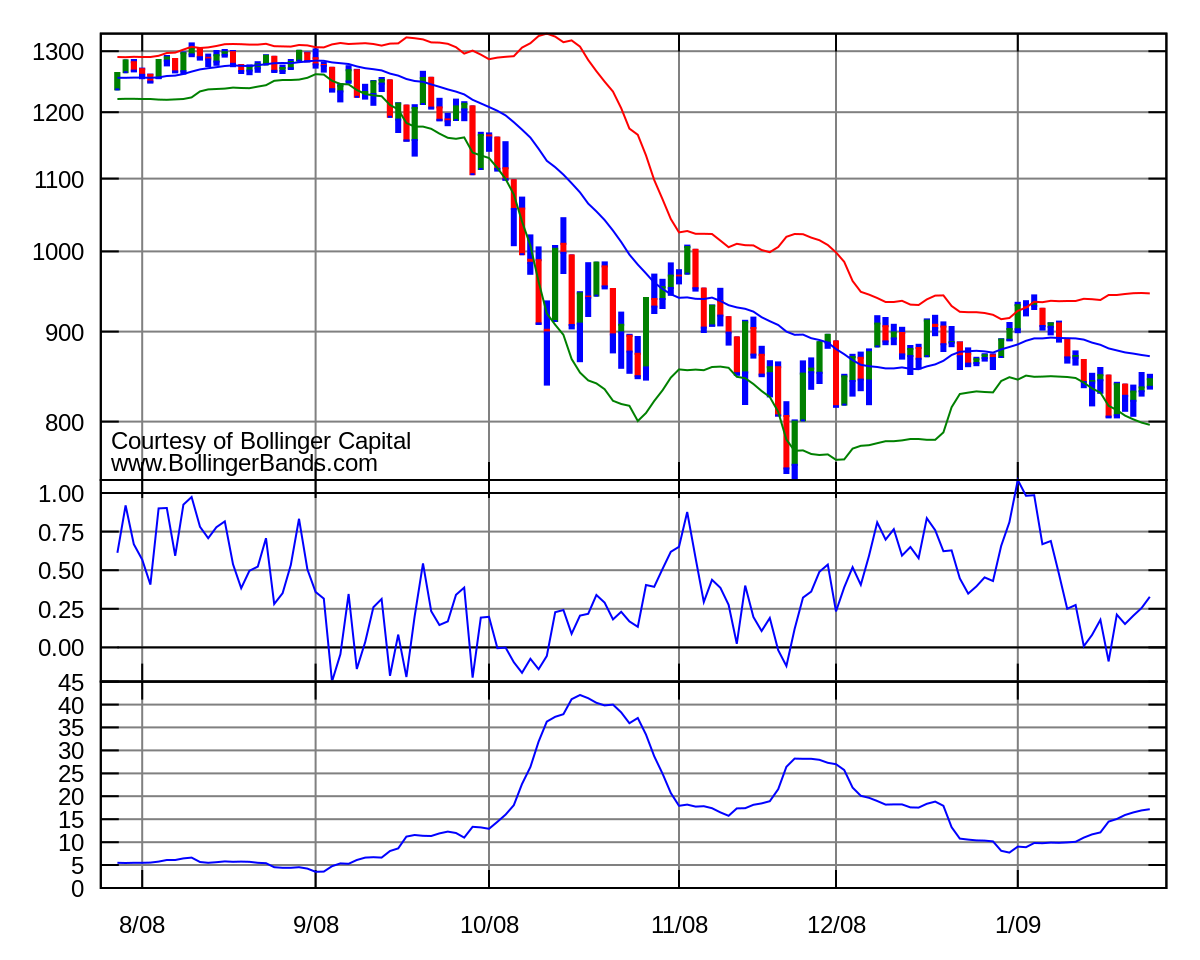

In this video I cover the first secret pattern that i use on daily basis in my analysis – the Band to Band move in bollinger bands.

The band-to-band move pattern tells you where the price is expected to reverse which could be used as an entry point (picking up the end of a corrective move). It could also be used to find big trend reversal.

► My websites:

http://www.tradersacademyclub.com

https://vladimirribakov.com/

https://vladimirribakov.com/get-products/

https://vladimirribakov.com/performance-new/

► Social Media:

http://www.youtube.com/VladimirRibakov

https://www.facebook.com/tradersacademyclub

https://twitter.com/VladimirRibakov

Bollinger Band Reversal Pattern, Bollinger Bands Secret Pattern – Webinar Part 1 by Vladimir Ribakov.

The Benefits And Drawbacks Of A Live Forex Trading Room

Developed by John Bollinger, the Bollinger Band is extensively utilized as a gauge of volatility. The commodities market appears to have a couple of changes as well. There are a lot of materials about Forex trading on the internet.

Bollinger Bands Secret Pattern – Webinar Part 1 by Vladimir Ribakov, Search top reviews relevant with Bollinger Band Reversal Pattern.

Forex Trading With Bollinger Bands – A Trending Trading Method That Just Plain Works!

A more sophisticated financier can tweak Straddles to create numerous variations. These include pattern lines, moving averages, Bollinger bands and more. You are completely knowledgeable about your strengths and weaknesses as a trader.

Having control over your financial investments using the very best FOREX chart indication is vital in achieving success. There are a great deal of trading indicators that you can utilize, and not a single one will stand apart above the rest. You require to use a combination of two or more trading indicators to be efficient in an offered scenario and the mix of which will also differ, depending upon the factors readily available in the existing market.

Bollinger Bands estimate the possible high and low price of a currency set based on market’s current level of volatility. The bands are drawn at an equal range above and below a simple moving average.

Scalpers often engage in multiple trades each day. Some traders carry out numerous trades and make revenues with ease. Do not worry, I will teach you the technical knowledge of scalping the market. Scalps are performed in the direction of the present pattern of the Forex market. You can’t run away from the reality that the “pattern is your good friend” if you do not know the trend of the marketplace, don’t place any order.

So the finest approach is to trade 3 lots when you have a high probability setup and you have actually recognized it on your inner scale. The first lot ought to be aligned with the monetary. The 2nd Bollinger Bands Trader lot needs to be lined up with the technical aspects of the trade something like the variety width. Expect the range is 60 pips wide. The very first lot ought to have a limitation of 20 pips. You can set the limitation to 40 pips something shorter than the other side. The third lt can be like a wild card.

This is where a lot of Bollinger Bands traders fail. From the outset they do not understand what type of trader that they wish to be. The expert is a day trader or an option-only trader, so you ought to be, too.You should immediately follow fit if the expert is trading a $50,000 account or suggests a $10,000 account.

In other words type it’s a) comprehend how your trades work, b) determine when it is best to use them, c) identify those key market occasions/ sign occasions, and d) execute your trade/ search for another chance.

The truth is understanding cost motion is probably the very best thing you can do as a technical trader. You can’t do that unless you lastly discard your indications and lastly take note of what the rate is informing you.

Take a look at the time frame you utilize, can you see a level at which the cost has bounced off? What is the significance of two standard discrepancies? Must not cost more than a thousand dollars and continuous costs must be very little.

If you are finding updated and exciting videos related to Bollinger Band Reversal Pattern, and 10 Minute Forex Wealth Builder, Price Action Trading Trade Success Forex Option Equities Futures please list your email address in newsletter totally free.