“Bollinger Band Mastery: Proven Profit Strategies” #stockmarket#BollingerBands #TradingStrategies

Popular complete video top searched Short Swing Trading, Forex Trading Indicators, and Bollinger Bands Downtrends Trading, “Bollinger Band Mastery: Proven Profit Strategies” #stockmarket#BollingerBands #TradingStrategies.

Discover the power of Bollinger Bands with “Bollinger Band Mastery: Proven Profit Strategies.” This comprehensive video course equips traders with the knowledge and tools needed to leverage Bollinger Bands effectively. Learn how to identify trends, volatility, and potential reversals, and explore advanced strategies for maximizing profits. Gain confidence in your trading decisions and elevate your skills with this in-depth course. Enroll now and unlock the secrets of Bollinger Bands!

Bollinger Bands Downtrends Trading, “Bollinger Band Mastery: Proven Profit Strategies” #stockmarket#BollingerBands #TradingStrategies.

Leading Ten Stock Exchange Technical Indicators

Meanwhile, the S&P 500 has a bullish look with a relative strength above neutral. Forex software application is made by the specialists. The bands are 2 basic discrepancies away from the average.

“Bollinger Band Mastery: Proven Profit Strategies” #stockmarket#BollingerBands #TradingStrategies, Play more complete videos relevant with Bollinger Bands Downtrends Trading.

A Tiny Guide To Forex Trading

It can be something really simple like the cross of two various moving averages. The index has a netural MACD and is over its twenty and fifty day moving averages at 1,294 and 1,283. Forex trading signs can be your secret to all of this.

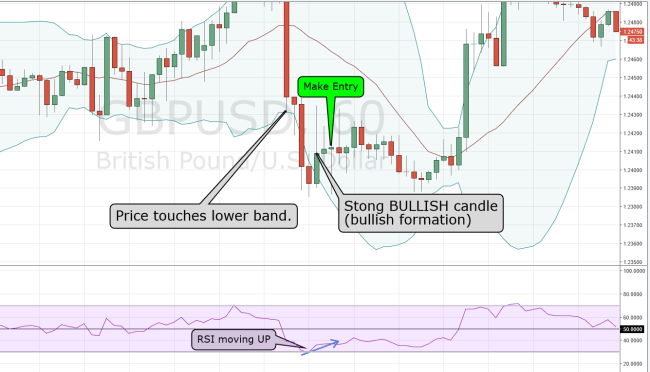

Bollinger bands are rapidly becoming my preferred sign. They are really simple to use, they are instinctive, and they inform you so much about the marketplace at simply a look. However how do you use Bollinger bands to make cash? Let me show you 3 simple actions that work almost whenever.

Bollinger Bands determine the marketplace’s volatility. Volatility informs us whether the market is rather or loud, stalling or moving. When the marketplace is peaceful, the Bollinger bands come together; when the market is moving, the bands spread apart. Usually peaceful times in the market show that it will break large open.

There are a number of charting software application plans offered online, some charge and some free. I like to use the complimentary ones and the one I use is kept in mind in my blog site. When you have the software application that has DMI/ ADX indications, set them as follows: ADX set at 5 smooth. DMI+ and DMI- to be set at 5 periods. I likewise add onto the chart Bollinger bands set at 20 periods basic and also add a 20 and 50 day moving average. The software application ought to allow you to change these settings.

Enter your trade as cost relocations past your Bollinger Bands Trader enter point and set a stop loss and earnings target. Watch the trade and change your stop loss to recover cost as soon as possible. Constantly search for sensible revenue targets and adjust them based upon your past results. The most essential goal is to handle the trade and not lose money.Even the very best entries can lose money if you don’t have a strong plan to handle the trade.

Nevertheless, if there is a breakout through one of the external Bollinger Bands, the price will tend to continue in the very same direction for a while and robustly so if there is a boost in volume.

The significance of utilizing a stop loss has been repeated by many skilled market individuals, consisting of the veteran fund manager Larry Hite in his sensible observation that “If you do not manage the threat, eventually they will carry you out.” His point being that no matter just how much money you make trading, if you expose yourself to unnecessary threat, you will stop working at some point. This was amazingly shown to be the case with our current monetary crisis for example – there was little to no regard for risk.

This forex trading method illustrates how focusing on a bearish market can benefit a currency that is overbought. Whether this method is right or incorrect, it provides an excellent risk-reward trade off and is well based on its brief position in forex trading.

Sidney felt sick as she looked at her most current OptionsXpress trading statement. As a little trader, we wish to go into and exit at one time considering that our order size is too little.

If you are looking most engaging comparisons relevant with Bollinger Bands Downtrends Trading, and Attitude Towards Trading, Learn How to Trade, Financial Markets dont forget to subscribe in newsletter now.