How to: My FAVORITE setup for Daytrades/SwingTrades (Bollinger Strategy and Squeeze Strategy)

Best full videos top searched Forex Trading With Bollinger Bands – 3 Things to Look for in a Profitable Trade, Price Moves, and Bollinger Bands Downtrends Strategy, How to: My FAVORITE setup for Daytrades/SwingTrades (Bollinger Strategy and Squeeze Strategy).

65% off of the SamuraiSqueezePRO: https://samuraialgo.com/products/samuraisqueezepro

Bollinger Bands Downtrends Strategy, How to: My FAVORITE setup for Daytrades/SwingTrades (Bollinger Strategy and Squeeze Strategy).

Technical Analysis Trading Your Way To Success In 4 Simple Steps

Bollinger Bands are utilized to determine the volatility of the marketplace. How do so numerous traders generate income trading the Nasdaq 100 every day. So, you will utilize that candlestick turnaround pattern to participate in a trade.

How to: My FAVORITE setup for Daytrades/SwingTrades (Bollinger Strategy and Squeeze Strategy), Enjoy more full videos about Bollinger Bands Downtrends Strategy.

Forex Leading Indications: Is There A Real Leading Indicator?

It can be cost breakout of the Bollinger Bands. The most popular trading sessions are the UK and United States sessions. In truth in my experience the easier the buy-sell signals the much better results I get.

Bollinger bands are rapidly becoming my favorite indication. They are very basic to use, they are user-friendly, and they inform you so much about the market at simply a glance. However how do you utilize Bollinger bands to make cash? Let me reveal you 3 basic actions that work simply about each time.

Another thing you need to understand before you join is are the moderators going to teach you how to trade, and if they are what are they going to teach you? If they are going to teach you how to trade using indications like stochastics and Bollinger Bands and you want to discover cost action techniques, then the space is not going to appropriate for you.

Scalpers typically participate in multiple trades per day. Some traders carry out numerous trades and make revenues with ease. Don’t worry, I will teach you the technical knowledge of scalping the market. Scalps are carried out in the direction of the current pattern of the Forex market. You can’t run away from the fact that the “pattern is your friend” if you do not understand the trend of the marketplace, do not put any order.

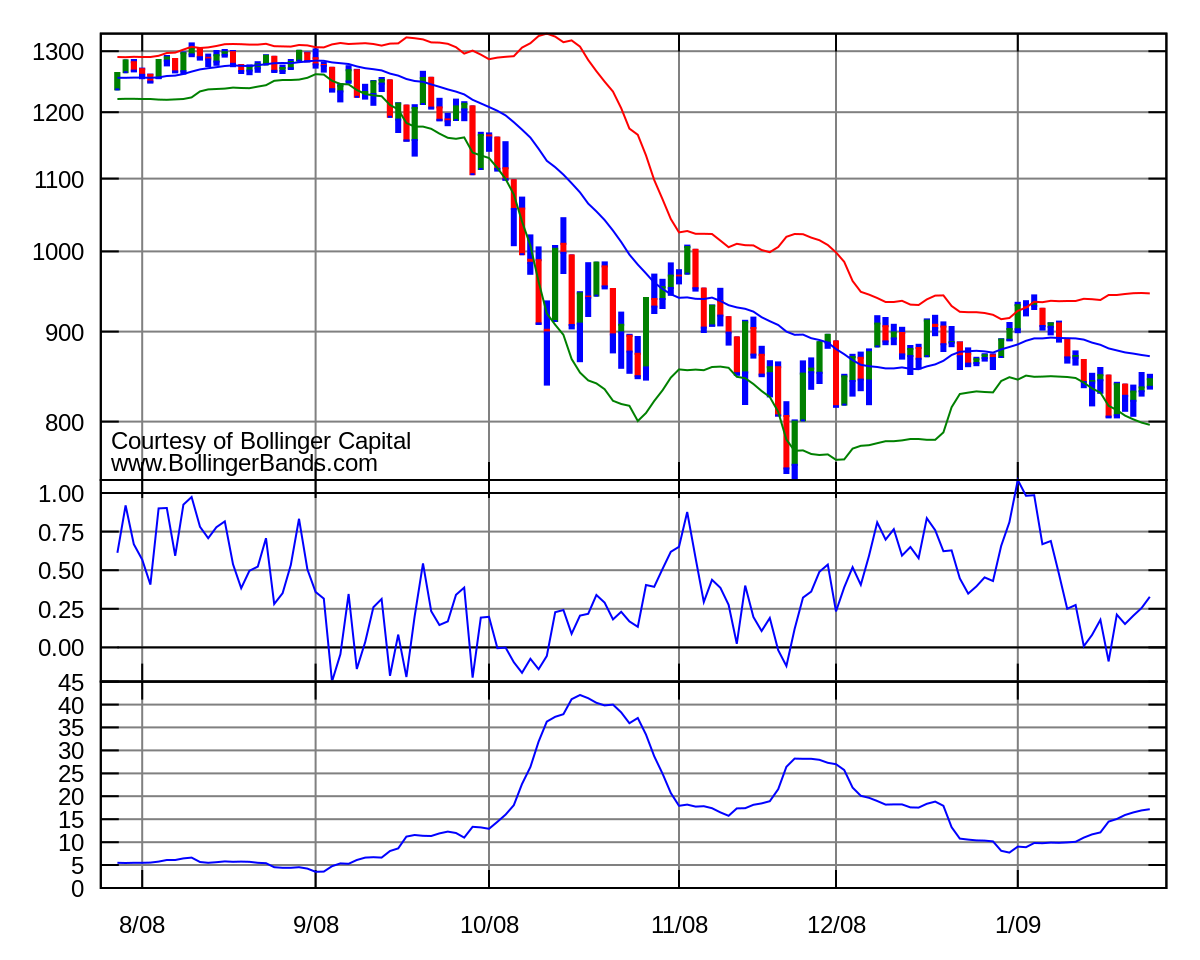

Bollinger Bands Trader bands plot a moving average in the middle, and the severe bands are formed by basic variance lines around that moving average. Now do not be frightened by the algebraic term basic variances. You do not need to understand how to calculate them – the indication does that by itself.

Each time you trade, you need to trade with the everyday pattern. It does not matter which timeframe you utilize (assuming you are utilizing one smaller than the everyday), you have to trade with the significant relocations Bollinger Bands . Recognizing the pattern is not that tough.

The value of utilizing a stop loss has been repeated by many skilled market individuals, consisting of the veteran fund supervisor Larry Hite in his sensible observation that “If you do not manage the risk, ultimately they will carry you out.” His point being that no matter how much money you make trading, if you expose yourself to unnecessary risk, you will fail eventually. This was marvelously revealed to be the case with our recent financial crisis for example – there was little to no respect for danger.

So they decide upon a rate that they think will appropriate for entering the marketplace. When the marketplace hits that price level, these big gamers go into the marketplace with the buy order. This price level infact ends up being the support. Similarly, in case of big sellers, they also prevent selling simultaneously. They also do not want to drive down the costs and make a loss. So they also go into the market slowly. By doing this they can get a reasonable cost. The cost level that they utilize to consistently enter the market becomes the resistance.

Possibly a major resistance line is close to the top of the band. Now do not be frightened by the algebraic term standard deviations. When a breakout occurs, a brand-new pattern is started.

If you are finding unique and engaging reviews related to Bollinger Bands Downtrends Strategy, and Trend Trading, Forex Trading Strategy, Short Swing Trading dont forget to join our email subscription DB for free.