How to Choose Technical Indicators for Stock Trading

Best complete video relevant with Techncial Analysis Forex, Stock Market Secret, Forex Account Manager, Technical Indicators, and Find Bollinger Bands Uptrends, How to Choose Technical Indicators for Stock Trading.

Technical indicators are trading tools that use historical price data to help investors identify things like a security’s trend and potential entry and exit signals. Learn how to sort through the numerous indicators by identifying four major categories of technical indicators: trend tracking, oscillators, sentiment, and flow-of-funds.

Subscribe: http://bit.ly/SubscribeTDAmeritrade

To learn more about technical analysis, tune in weekly to the Getting Started with Technical Analysis webcast for livestreamed interactive sessions with TD Ameritrade education coaches: https://bit.ly/GettingStartedWithTechnicalAnalysis

TD Ameritrade is where smart investors get smarter. We post educational videos that bring investing and finance topics back down to earth weekly. Have a question or topic suggestion? Let us know.

Connect with TD Ameritrade:

Facebook: http://bit.ly/TDAmeritradeFacebook

Twitter: http://bit.ly/TwitterTDAmeritrade

Open an account with TD Ameritrade: http://bit.ly/SignUpTDAmeritrade

#tdameritrade #stocks #trading

Find Bollinger Bands Uptrends, How to Choose Technical Indicators for Stock Trading.

Channel Trading System

There are lots of theories that propose to provide great stock market trading instructions. It is necessary the picture is as detailed as possible. The concepts are easily appropriate for routine stocks or alternatives trades.

How to Choose Technical Indicators for Stock Trading, Watch interesting complete videos about Find Bollinger Bands Uptrends.

Forex Trading With Bollinger Bands – 3 Things To Look For In A Successful Trade

In addition, the typical specifications offer you a great starting point. Once you have the software that has DMI/ ADX indicators, set them as follows: ADX set at 5 smooth.

Today lots of traders buy commodity trading systems and spent money on pricey software when truly all they require is to do a bit of research on the web and construct their own.

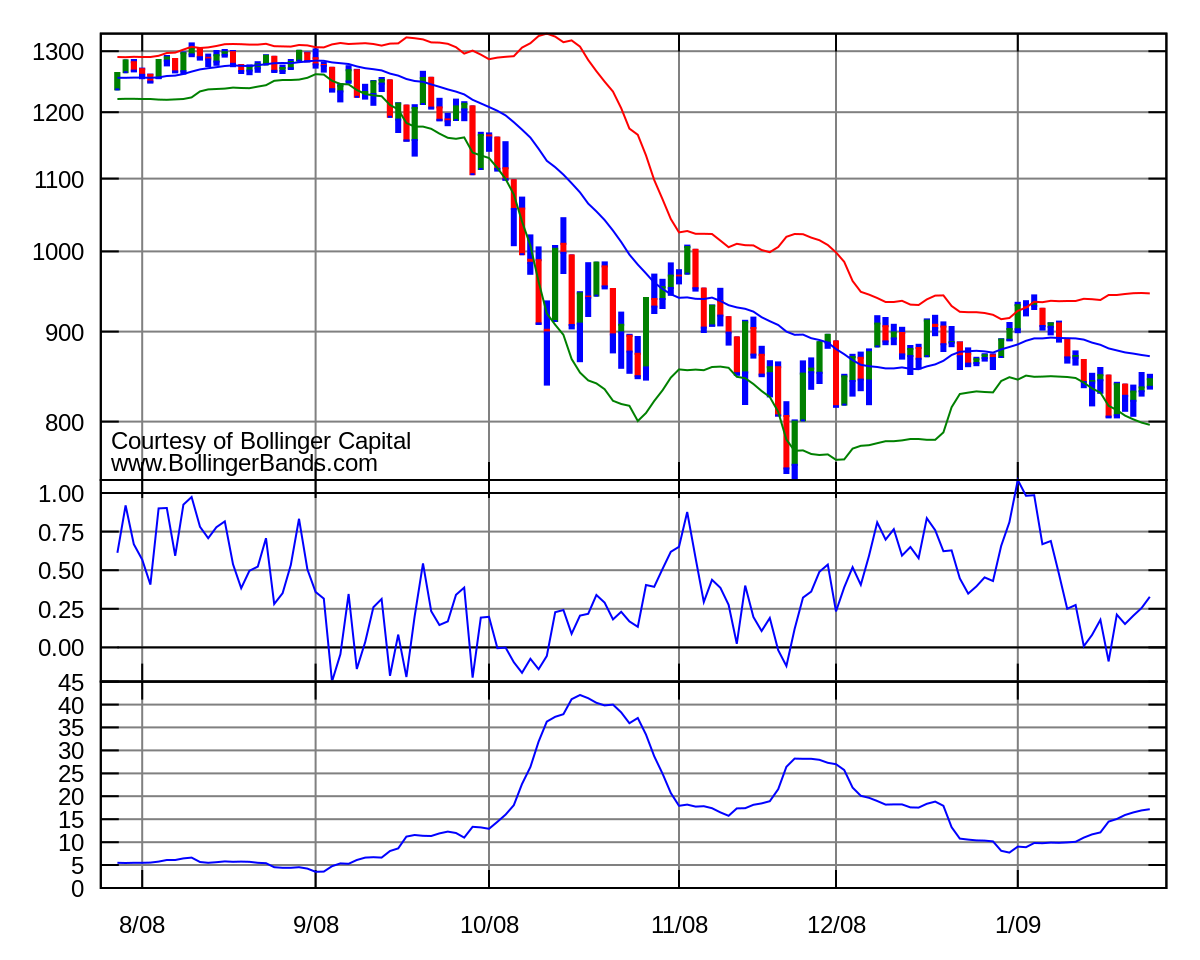

That plan is to find an excellent selling cost (utilizing 2,20 Bollinger Bands, moving averages, and momentum indications). I am approaching the marketplace with a predefined set of ideas for the day.

Due to the fact that simple systems are more robust than complex ones in the harsh world of trading and have less components to break. All the top traders utilize essentially easy currency trading systems and you should to.

And annoying it is! In 2004 I opened up my first FOREX account with simply a couple of hundred dollars in order to test out the waters a bit. I figured, “OK, how hard can this be? I’ll just set my targets at 3 times the distance to my stops so I’ll have a 1:3 risk/reward ratio. Then, all I need to do to make a revenue is be right more than 25% of the time on my trades. Any dolt can do that, right?” Well this dolt apparently couldn’t, since about a dozen trades later on I believe I may have struck my target about twice Bollinger Bands Trader . Every other trade was stopped out. Amazing. What was taking place?

In back testing, it appears that each time the fast and sluggish stochastics lines crossed each other, it was the specific Bollinger Bands point where there was an advantage or drawback swing.

Are you fully encouraged that God does not oppose trading? Do you regard trading as “unclean”? Do you have doubts in your spirit about the matter? “Blessed is the man who does not condemn himself by what he authorizes. However the male who has actually doubts is condemned if he consumes, since his consuming is not from faith; and whatever that does not originate from faith is sin” (Romans 14:22 -23, NIV).

When you need to lock in revenues or when you should position an order to purchase or sell, stochastics can help you if you want to determine. Nevertheless, do not simply count on one of these indications. Use several of them and change your trading strategy according to what you see.

The ADX line, above the cost chart, stays bullish, given that the green line is above the red line. Another method to identify the range is to utilize some kind of sign. This sort of channel is popular as Bollinger Bands.

If you are searching unique and engaging videos related to Find Bollinger Bands Uptrends, and Stock Pick, Learn Foreign Currency Trading Online you should join for email list now.