Mark Putrino's Institutional Trading Research | 5-20-2024

Top vids about FX Market, Futures Trading, and Bollinger Bands Uptrends, Mark Putrino's Institutional Trading Research | 5-20-2024.

Mark Putrino’s Institutional Trading Research provides you with an approach & guidance in the market, that is enlightening to the beginning trader and valuable to the seasoned trader. His attention is on the SPY and the Sectors that make up the SPY, spend some time on this channel and you will see a transformational change to your trading.

Meet The Stock Market Jobber ~ Mark Putrino, CMT

~ Traded directly for two of the best money managers in the history of the industry, Mario Gabelli and Steve Cohen.

~ Head of trading at three institutional money managers.

~ Developed and managed various trading strategies. These include convertible arbitrage, AI driven algorithmic strategies, program trading, market-making and pairs trading

~ Master’s of Business Degree – Emphasis in Finance – New York University

~ Holder of the CMT designation.

~ Long standing member of the Market Technician’s Association

~ Former professional classical guitar player

~ Avid (but not very good) golfer

markputrinocmt.substack.com

www.stockmarketjobber.com

on X: StockJobberOG

Instagram: StockJobberOG

On META: StockJobberOG

==============================================================================

Stock Jobber Reading List

Panic on Wall Street: A history of America’s financial disasters

https://amzn.to/4bDo7N7

Ten Years in Wall Street: Revelations of Inside Life and Experience on Change

https://amzn.to/3QMeNyC

Mindtraps: Unlocking the Key to Investment Success

https://amzn.to/3yibvN3

Japanese Candlestick Charting Techniques, Second Edition

https://amzn.to/3QNb041

Reminiscences of a Stock Operator

https://amzn.to/3wqDjyp

The New Trading for a Living: Psychology, Discipline, Trading Tools and Systems, Risk Control, Trade Management

https://amzn.to/44Ybvyh

New Market Timing Techniques: Innovative Studies in Market Rhythm & Price Exhaustion

https://amzn.to/3UIe2Yt

Technical Analysis and Stock Market Profits

https://amzn.to/3WZu8zV

The Scarlet Woman of Wall Street: Jay Gould, Jim Fisk, Cornelius Vanderbilt, the Erie Railway Wars, and the Birth of Wall Street

https://amzn.to/3V1yu71

Andrew Jackson and the Bank War (Norton Essays in American History)

https://amzn.to/3ycd6Uz

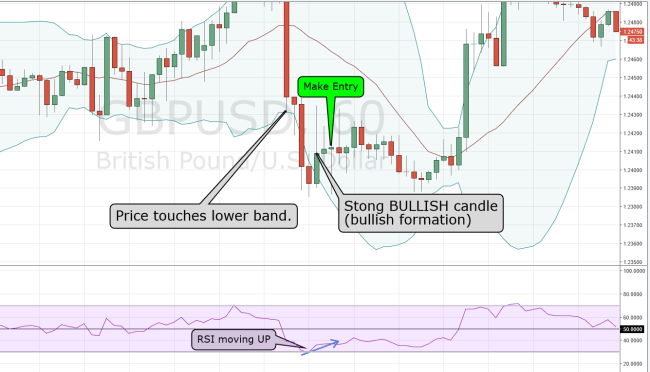

From beginner stock traders to more experienced ones, the videos on this channel can help you with: Learning simple Technical Analysis, Effective chart patterns, Measuring trade targets & Identifying good stops for trades. We do this through Technical and Fundamental Analysis. We use simple momentum indicators like the MACD, Bollinger Bands, RSI to analyze and predict trends or trend changes using divergence and overbought/oversold readings.

Disclaimer: All of the information, material, and/or content contained in this program is for informational purposes only. Investing in stocks, options, and futures is risky and not suitable for all investors. Please consult your own independent financial adviser before making any investment decisions.

Bollinger Bands Uptrends, Mark Putrino's Institutional Trading Research | 5-20-2024.

Forex Trading With Bollinger Bands – A Trending Trading Strategy That Simply Plain Works!

It can be certain moving averages, pivot points, candlestick patterns, and so on. Prices will then relocate to target the mid section of the Bollinger Bands. How does BB King being “horrible at chords” assist me and by extension you?

Mark Putrino's Institutional Trading Research | 5-20-2024, Explore popular replays relevant with Bollinger Bands Uptrends.

Bollinger Bands Described – My Preferred Indicator

When the marketplace strikes that rate level, these huge players get in the marketplace with the buy order. You are totally familiar with your strengths and weak points as a trader. Forex software is made by the experts.

We will presume that you are considering entering into the stock exchange. Naturally you have high expectations of obtaining a very significant return on your capital on which you plan to invest.

The 3rd chart is a three-year SPX month-to-month chart with Bollinger Bands. At the start of the cyclical bull market, SPX rallied into the upper half of the month-to-month Bollinger Bands and after that normally traded between the upper and middle bands. In October 2005, SPX fell to the middle band, rallied to the upper band, and after that traded simply listed below the upper band, which has been resistance. Likewise, the ZigZag line reveals each time SPX increased to the upper band, it pulled-back towards the middle band. The previous 2 times SPX rallied to the upper band, it pulled-back over 7% and over 6% within three months.

If you take a look at any chart you will see long term patterns lasting for months, years or weeks and smaller patterns of a couple of days, to few weeks which represent small responses in the pattern that become overbought and oversold.

The details about when you use stops and limitations while stock trading are identified by your trading system.However before we look at some typical techniques, let’s talk about Bollinger Bands Trader a couple of things NOT to do.

Stochastics – When the market is trending is essential to adapt the oscillator to the exact same conditions: When the market is trending up, then the signals with the higher likelihood of success are those in direction of the trend “Buy signals”, on the other hand when the market is trending down, offering signals offer the most affordable danger chances. Divergence trades are amongst the most trustworthy trading signals. When the indication reaches new highs/lows and the market fails Bollinger Bands to do it or the market reaches brand-new highs/lows and the indicator fails to do it, a divergence takes place either. Both conditions mean that the marketplace isn’t as strong as it utilized to be giving us opportunities to make money from the market.

Are you fully encouraged that God does not oppose trading? Do you regard trading as “dirty”? Do you have hesitations in your spirit about the matter? “Blessed is the male who does not condemn himself by what he approves. However the male who has actually doubts is condemned if he consumes, due to the fact that his consuming is not from faith; and whatever that does not originate from faith is sin” (Romans 14:22 -23, NIV).

There are many high-quality stocks that stopped working to take part in the current rally. Consequently, I ‘d anticipate price variations to close rather in a debt consolidation phase. Many drug stocks e.g. PFE BMY LLY ABT AZN and so on remain out of favor, while other stocks e.g. LU FNM X INTC CSCO DELL and so on have become much more reasonably undervalued. However, oil stocks remained high and GOOG increased above $400. Oil costs and economic reports ought to continue to influence the marketplace. The U.S. stock exchange will be closed Thursday for Thanksgiving. Economic reports next week are– Monday: Leading Indicators, Tue: FOMC Minutes, Wed: Unemployment Claims, Revised Michigan Consumer Sentiment, and Oil Inventories.

Keep these basic pointers in mind while you are learning forex trading. When a large number of sellers go into the marketplace, price action recovers down towards the assistance. This can be successfully chalked out through Fibonacci.

If you are searching most exciting videos about Bollinger Bands Uptrends, and Best Forex Trading, Free Forex Charts, Stock Trading you are requested to list your email address for email subscription DB for free.